Disclaimer: We share general insurance tips and insights — not licensed advice. Always check with a qualified insurance professional before making decisions. See full Disclaimer.

Insurance Policy Authority

Insurance advice for auto, home, and life.

Auto Insurance: Coverage

This section is the single most important part of this entire guide. It is filled with a lot of valuable information; so, pace yourself and try to get a full understanding of the information.

So what exactly is coverage?

In the previous section, we talked about how insurance, as a complete service, is all about providing protection. We then summarized coverage to be, more specifically, a list of items we want to protect.

We also said that having car insurance protection is kind of like having a shield or a safety net. If that’s the case, then coverage would be the actual size of the shield or net. It’s what dictates what all you are protecting. In theory, having more coverage would mean having a bigger shield or net.

Coverage is the single most important part of any car insurance policy.

If you were to ever get into an accident, the first thing you should be thinking about is your coverage. That way you can know right away if the insurance company will cover the expenses related to those damages.

Now there are many different parts to coverage in a car insurance policy, and understanding these many parts can seem a bit complicated to the average person.

The key to understanding coverage is to first know that there’s an exact list of items/areas that you can protect; and also that there are specific coverage types that provide protection for each of those areas. So the first task is to know all the different coverage areas that exist and then afterward know all the coverage types available for each area.

Coverage = areas + types

To help you better understand coverage in an auto insurance policy, we designed a unique visual explanation that we feel makes the topic super easy to understand.

The first thing we must do to get a clear understanding of coverage is find out everything it provides protection for. To do that, we’ll take a look at the different areas of coverage.

Areas of Coverage

One of the most common mistakes people make is thinking that car insurance (like the name suggests) is only there to protect your car, and that’s not the case. There are multiple items/areas that car insurance could provide protection for, aside from your car.

To start off we’ll think of coverage as a single whole unit. For illustration purposes, we chose to display it as a complete circle. Then from here, we’ll break it down into its individual areas.

To help identify the different areas, we’ll imagine a scenario in which you’re involved in an accident with another car.

The way we see it, there are 2 possible sides to which damage could occur. Your side and the side of Others involved (another driver).

Furthermore, there are 2 classifications for things that could get damaged on either side. These are: living things and non-living things; or to be more specific, People and Property.

So when pieced together we see the 4 main areas of coverage.

You: this first area provides protection for you, and by “you” we mean yourself and the passengers inside your car.

Your car: as you probably guessed, this area provides protection for your car.

Other people: this one provides protection for any other person injured in an accident you caused. These may include other drivers, passengers, bikers, or pedestrians.

Other Property: this area provides protection for other people’s property damaged in an accident you caused, and may include other cars and structures (such as a fence or building). It may also include public property such as fire hydrants, light poles, and bridges.

So those are the 4 main areas of coverage. It is these four areas that make up the foundation for coverage in an auto insurance policy.

How Auto Insurance Is Classified

Before we dive into the different types of coverage, it’s important to understand that auto insurance policies are generally classified into two main systems based on how accidents are handled: at-fault and no-fault auto insurance.

At-Fault Auto Insurance

In an at-fault (or tort) system, the driver who caused the accident is financially responsible for the damages. This means that after an accident, fault is determined, and the at-fault driver’s insurance pays for injuries and property damage suffered by others.

Most U.S. states follow this system. Under at-fault insurance, liability coverage plays a major role, as it is designed to protect you if you cause harm to other people or their property.

No-Fault Auto Insurance

In a no-fault system, each driver’s own insurance pays for certain expenses—typically medical bills—regardless of who caused the accident. The goal of no-fault insurance is to reduce delays and lawsuits by allowing drivers to receive compensation more quickly.

No-fault insurance does not mean fault is never considered. In serious accidents or for certain damages, fault may still matter, and lawsuits may still be allowed depending on the state.

Why This Matters:

Understanding whether your state uses an at-fault or no-fault system helps you understand why certain coverages are required, how claims are paid, and what protections are most important for you.

With that foundation in place, we can now look at the different types of coverage and how each one protects a specific area of an auto insurance policy.

Types of Coverage

For each coverage area, there are different types of coverage that provide protection for that specific area. The chart below shows how a coverage type provides protection to its respective area. If a coverage type appears in an area, this simply means it covers expenses related to that area.

We now take a look at some of the most common coverage types for each area.

Personal Injury Protection or PIP: this type pays for treating injuries to you and your passengers.

Collision or Coll: this type pays for damage to your car caused by a collision with another car, object, pothole, or flipping over.

Comprehensive or Comp: this coverage type pays for damage to your car that’s not caused by a collision. This may include fire, theft, vandalism, falling objects, hail, flood, or hitting animals.

Bodily Injury Liability or BIL: this type pays for treating injuries you caused to other people.

Property Damage Liability or PDL: this coverage pays for damage you cause to someone else’s car or other objects and structures.

Both coverage types related to the side of others (BIL and PDL) are collectively known as Liability Coverage.

So now we get a look at the most common types of coverage for all the areas combined.

Remember, these are only some of the most common coverage types; there are other types available. You can review our Coverage Type List to see the standard types of coverage available.

This list of the different coverage areas and types is what you have available to choose from when building your car insurance coverage; since the areas and types are primarily what coverage is built around. Coverage = areas + types.

It is not super important for you to know about every single coverage type that exists. However, it’s very important that you know about the types required in your state; since some coverage types are required by law to protect certain coverage areas. For example, you’ll be required to have BIL (bodily injury liability) coverage in most states to cover other individuals’ medical bills if you injure them in an accident. The coverage types required in each state vary and a few states don’t require car insurance coverage at all. But before we discuss the types required in your state; let’s first take a look at how coverage is sold.

How Coverage is sold

The business of insurance is one that puts a lot of focus on money or dollar value.

You pay a certain dollar amount to the insurance company and the insurance company agrees to pay out a certain dollar amount to have things fixed.

When buying coverage from a car insurance company, typically you will see the coverage type followed by the limit.

The limit is the maximum dollar amount the insurance company would pay out for expenses related to a coverage type.

There are two main groups to which limits typically fall; those for which you can choose the limit amount and those for which you can’t choose the limit amount.

First, we take a look at the ones for which you are able to choose the limit amount.

For this group, there are two main limit types, single limit and double limit.

Below is a common example of how the single-limit setup would look and what it means.

In this scenario, you’re being offered Property Damage Liability coverage with a limit of $15,000. This means the insurance company would pay for expenses relating to damage you caused to other people’s property, up to a maximum of $15,000 per accident. The single-limit setup is pretty straightforward.

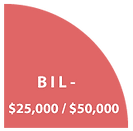

So now we take a look at the double-limit setup, and like the name suggests there are two limits involved.

In this example, we are being offered Bodily Injury Liability coverage with a limit of $25,000 and $50,000. In this case, the first amount is the limit “per person”, which means $25,000 is the most that would be paid out for medical treatment on any one person from the other side, injured in an accident. And the second is the limit “per accident”, which means $50,000 is the most that would be paid out per accident towards treating injured people from the other side, regardless of the number of persons injured in the accident.

To help you get a better understanding of how the “per person” and “per accident” limits can get a bit tricky, we’ll imagine some example scenarios.

Let’s just say that 4 people, from within a car that you caused an accident to, got injured. 1 of them received injuries that amounted to a $30,000 medical bill and the other 3 got a medical bill of $5,000 each. If we total all the bills they come up to $45,000. Now even though that is less than the $50,000 limit per accident, the insurance company will only pay out $40,000 towards those expenses. That is because it will only pay $25,000 towards the first person’s $30,000 bill since $25,000 is the per-person limit. And then also cover the other 3 $5,000 bills.

So now let’s imagine that you caused another accident in which 4 people from the other car got injured once again. This time they each racked up medical bills amounting to $15,000. Now even though each person’s bill is less than the $25,000 per-person limit, the insurance company is not going to completely pay for all those individual bills. That is because if we total all the bills they add up to $60,000, which is more than the $50,000 per accident limit. In theory, the insurance company would only pay $12,500 towards each person’s $15,000 bill bringing the total payout to the per-accident limit of $50,000.

So that gives us a look at how the single and double limits are offered.

These are just some of the most common coverage types that use the single and double-limit setup. Keep in mind that there are other coverage types that use these as well.

Remember that you are able to set the limit amount for the single and double limit types, so you can always increase the limit to suit your needs.

We must also mention that BIL and PDL coverage (the ones on the red side) are often times sold in a slightly different way than displayed above.

In this other version, both types are grouped together under their umbrella term “Liability Coverage”.

When done this way you will see all 3 limits together as one, instead of being separated as single and double limits.

Note that the first 2 figures will always relate to BIL coverage and the last figure will relate to your PDL coverage.

Because we are using our diagram to display the coverage types we’ll keep them separated. But just know that some insurance companies may group them together.

So now that we have covered the ones for which you can choose the limit amounts, let’s take a look at the ones where you are not able to do so.

These types are primarily focused on the area of coverage that provides protection for your car. More specifically it relates to the two main coverage types for that area: Collision and Comprehensive coverage.

The main reason why you are technically not able to set the limit amount for these coverage types is because the limit amount is actually based on the value of your car.

See whereas most of the other coverage types allow you to set a maximum amount or limit for the insurance company to potentially pay out. These two coverage types actually rely on the estimated value of your car to determine the maximum payout.

And the reality is, that the value of your car changes with time. Each day that passes devalues or depreciates the value of your car; oftentimes even if you don’t use it. So since the value of your car changes constantly, there is no fixed limit.

If you totaled your car, the insurance company will pay out the depreciated value of your car at the time.

So when you’re buying these two types of coverage you typically won’t see any limit amounts. Instead, you will actually see a deductible amount next to these two coverage types if you do purchase them.

Deductibles

Collision and comprehensive coverage types are governed by what is called a deductible system. Let us explain a bit further.

So in a perfect world things would work in a straightforward and logical way.

Logic would then lead us to think that whenever we have an accident, such as a fender bender, for example, the insurance company will simply pay to have our car fixed. Since you are paying to have collision and comprehensive coverage and the main reason you got the service is to have your car fixed when it gets damaged. But no, unfortunately, that is not the case. It doesn’t work in that straightforward type of way.

In between the fender bender happening and the insurance company paying to have it fixed, a deductible amount comes into effect.

Now a deductible is a dollar amount you (as the policyholder) must pay out-of-pocket on a claim; before the insurance company steps in to pay for the remaining balance of the expenses (if any) related to that claim.

So for example, if you have collision coverage with a deductible of $500 and you accidentally hit a tree that causes $1200 worth of damage to your car. When you file the claim with your insurance company you must also be prepared to pay the $500 deductible first, towards the $1200 bill, and then afterward the insurance company will pay the $700 balance on the bill.

If the expenses to fix your car totals less than your deductible (using the same example above, but instead of $1200 let’s just say the bill totals $400) then you need not file a claim with your insurance company. Instead, you are expected to simply pay to have the repairs done on your own.

As a reminder, a claim is simply the official way for a person/policyholder to inform the insurance company that damage has occurred and for which they have coverage. Or in short, that the “conditions” have been met and it is now time for the insurance company to step in and do their part.

So if you file a claim with your insurance company for damage to your car, you will need to pay the amount of the deductible first to repair your car. Keep in mind you will need to pay this deductible each and every single time you file a claim with your insurance company for damage to your car; even if you are not at fault for the damage.

It’s also important to know that you are able to choose your deductible amount and that the deductible amount has an effect on your premium or the price you pay for your coverage; oftentimes with higher deductible amounts resulting in lower premiums.

So when buying Collision and Comprehensive coverage, instead of seeing the typical limit amount listed after the coverage type, you’ll see the deductible amount.

And so now we can get a better look at how some of the most common coverage types are typically sold.

These 4 areas with coverage types and limit amounts are what make up your coverage. This is also known as a coverage chart.

Now you may not necessarily need to have coverage in every area in order to create your personal coverage chart. The main deciding factor in determining what your coverage must include is your state minimum.

Minimum Amount of Coverage

As we mentioned before, auto insurance is required by law in almost every state. If it is required in your state then there’s also a minimum amount you must get.

The minimum is set for (1) the amount of coverage types required, as well as for (2) the limit amounts for those types.

The minimum required varies by state.

Below is the complete list of all the states and their minimum. Simply click on your state and the minimum required amounts will appear in a coverage chart.

State Minimum List

Note: “Minimum requirements and offer-but-declinable coverages vary by state and may change. Some coverages require written rejection. Always verify with the state or insurer.”

You should also take a look at the Coverage Type List to see the different types of coverage available for each area. Even though coverage for a particular area may not be required in your state, it is always good to know the type of protection available in case you choose to have it.

It is important to know that having the state-required minimum will simply keep you in compliance with the law. In most cases, a person would need more than the state minimum to have proper protection.

Choosing the Right Amount of Coverage

Now to start you off on the path to choosing the right amount of coverage you need, we’ll take a look at what’s at stake if you don’t have any or enough protection for each area. This should serve as a sort of “eye-opener” for you, so you can focus on all that’s important to you in your life.

For the first area, that protects you; at stake would be the quality of life (or even life itself) of you, your loved ones, and your passengers. By not being able to receive the proper medical treatment needed, because you couldn’t pay for it.

At stake in the second area would be the mobility of you and your family. Not being able to get about your daily routines because you couldn’t pay to have your car repaired or replaced.

In relation to the side of others (Liability Coverages), at stake for you would be your assets (including the things you own and the savings you have) and also your freedom; as you will be held financially responsible for damages you caused to other people and property. Not being able to pay for damages through insurance coverage may mean sourcing the funds from your personal assets. And if you don’t own enough assets, it may mean serving jail time.

Those cover the main things at stake in each area.

Next, we take a look at what is widely considered to be the industry-recommended amount of coverage for each area.

It is believed that these amounts should provide enough protection for most people.

Note however it is very important that you still take the time to determine the amounts that are enough for you, and not just rely on the industry-recommended amounts. These should simply be used as a sort of measuring stick to help guide you. You may end up needing less or more than these industry-recommended amounts depending on your personal needs.

At this point, there is one specific group of people who we’d like to address; and that’s the people who are simply looking to buy car insurance at the cheapest possible price. Now since your main deciding factor is actually based on a price point (cheapest), the amount of coverage you get is not as significant to you. Moreover, because the pricing will be on the lower end, the amount of coverage you get will more than likely be somewhere close to your state minimum (the least amount of coverage allowed). So for now you can choose to either move on to the next section on Pricing, and simply use your state minimum as the right amount of coverage for you. Or you can still go through the process of finding out the amounts that would truly be enough for you, even though you more than likely won’t buy that much. It’s up to you, but we suggest you still go ahead and find out the amount that’s right for you since there is still value in knowing for future reference.

So now let’s get to you choosing the amount that’s right for you.

First off, we must mention that this process isn’t perfect or foolproof; it’s simply a way for us to try and guide you to the ideal limit amounts that will work for you. Keep in mind that we don’t know your budget. Moreover, the simple fact is that no one can tell the magnitude of a future accident or the severity of injuries if one occurs; and so we can’t tell you how much insurance to buy in preparation for future accidents. Even if we suggested that you max out all your car insurance coverages and limits (which will be costly), the truth is that you may never get into a serious accident to fully utilize all that protection. In that case, we would have advised you to spend more on coverage you didn’t really need. And if we told you to get lower limits to save on cost; then that could put you and your family’s livelihood at risk if you get into a serious accident and don’t have enough coverage. All we can do is guide you through the process of deciding those coverage limits on your own.

So let’s get to it.

You can either print out a copy of our Blank Coverage Chart or you can draw a circle on a piece of paper and divide it into four sections just like our coverage chart.

The goal here is to have it filled with the coverage types and limits you feel are enough for you.

First, fill in the coverage types required in your state, since these are the ones you must have. You may want to have your state minimum chart open for reference.

Then fill in the coverage types that are not required in your state, but which you’d still like to have (if any). If you haven't already considered all the different coverage types, then now would be a good time to take a look at the complete Coverage Type List to see the types available for you to choose from. Once completed, fill in the types you want.

So at this point, you should have a coverage chart with coverage types in it.

The goal next is to fill in limit amounts that you believe would provide enough protection for each coverage type listed on your chart.

As we saw earlier, on either side of your coverage you’re protecting either people or property. And so these two things are what matters most when considering your limit amount.

We start first by taking a look at protection for people.

The main thing you want to find out is the general cost of medical treatment in your area since medical treatment is the main way of providing protection for people on either side.

Think of a scenario where multiple people inside your car or another car get injured. Then answer this question. Do I have enough coverage to get everyone the medical attention they need? Remember that depending on the coverage type you may need to think of 2 limits: one per person and one per accident.

We believe life is the greatest gift of all. It is priceless, and so you should do all you can to protect it. So think about this when considering your limits for these two areas.

Next, we take a look at protection for property.

For the area that provides protection for your car, imagine that your car gets damaged in multiple different accidents, and quite possibly, over a short period of time. Then ask yourself, can I pay the deductible amount each time to have my car fixed?

We generally suggest that people go with a lower deductible amount; unless they can, for sure, afford to pay a higher one each time they file a claim for damage to their car.

Now for the area that protects other people’s property. We suggest you consider the class of neighborhoods you travel through on your daily routes. This should give you an idea of the amount of coverage you may need. Try to think of a number that could cover damages to any of the cars and homes in those areas. It’s not a foolproof plan, but it should at least give you an idea of a dollar amount to plan for.

Your personalized coverage chart is now complete. You should have an idea of the ideal amount of coverage that would work for you.

Optional Coverage

Aside from your core package of coverage, there are also some optional coverage types that are available and that can add extra protection to your policy.

Below we’ll take a look at some of the most common optional coverage types available.

Rental reimbursement - pays a limited amount for daily rental car charges while your car is being repaired for covered damages. Policies usually limit the dollar amount and the number of days covered. In some states rental car coverage would fall under your comprehensive and collision coverage; however, there are variations in how this coverage applies. If you want to know what your auto policy will cover when you rent a car, ask the insurance company.

Towing coverage (also known as Roadside Assistance) - reimburses you for your costs if your car is disabled. For example, the coverage might cover the cost if you have your car towed to a service facility or you lock your keys in the car.

Guaranteed Asset Protection (GAP) insurance - may help pay off what you owe if you owe more on your car than it is worth. It would provide protection whether the accident is your fault or someone else’s. This protection can be purchased from a lender, your car dealer, or an insurance company. Contact one of these entities if you want to know more about this coverage.

Note that these are just some of the most common optional coverage types, there are more types available. Also different insurance companies might refer to certain coverage types by different names, even though they provide the same protection. So you may not see the exact same names as the ones listed here.

As we mentioned before these coverage types are typically optional and can be added to your policy for extra protection. Note that any of the optional coverages you add to your policy will likely increase your premium, so consider it carefully before you add any of them.

So now that we have gone over both the core coverage and the optional coverage types we now have a more complete understanding of coverage in a car insurance policy.

That does it for this section on Coverage.

Next we move on to the Pricing section.