Disclaimer: We share general insurance tips and insights — not licensed advice. Always check with a qualified insurance professional before making decisions. See full Disclaimer.

Insurance Policy Authority

Insurance advice for auto, home, and life.

Auto Insurance: Basics

This section is the building block for the rest of the guide. Here is where we lay the foundation for all the other lessons to come.

To cover the basics, we’ll answer three simple but very important questions about car insurance. These are: What is it? How does it work? & Why do we need it?

After answering these basic questions we’ll be informed enough to move on to the more detailed information in the other sections.

We begin with the first question.

What is it?

Car insurance is all about providing “protection”.

In theory, the protection that car insurance provides works very similar to how a shield protects a warrior on the battlefield; preventing the warrior’s body from absorbing hits from enemy weapons.

The main difference is that car insurance is a service and not something physical; so, it can’t physically protect you or your car from being hurt or damaged.

Instead, car insurance protects a person from financial costs (bills/expenses) that come about after physical damage has occurred; it prevents the person from absorbing financial “hits” resulting from a car accident.

This means that it prevents a person from having to spend their own money out-of-pocket to get their car repaired after an accident; instead, the insurance company (that provides the insurance protection) pays to cover the cost of repairing your car.

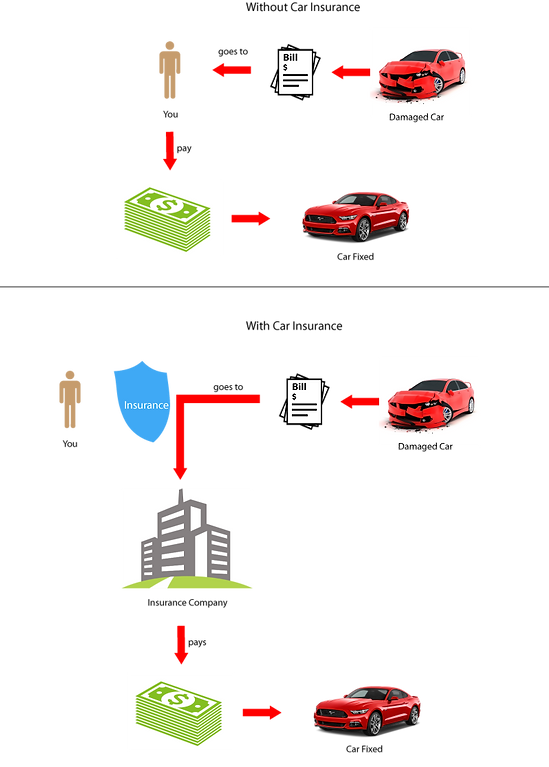

Below is an example scenario showing how an accident would be handled if you had car insurance; or if you didn’t.

So that is what car insurance is. It’s basically a service in which someone else (the insurance company) will pay to have your car repaired whenever it’s damaged in an accident.

Sounds amazing, doesn’t it?

Let’s take a closer look at how it works first, before falling in love with car insurance.

How does it work?

There are three main steps that detail how car insurance works. The image below shows how all three steps are connected.

Step 1

The first step involves you paying money to the insurance company to have the insurance service. That’s right, car insurance is not free and so you will need to pay to have the protection of car insurance.

The amount of money you pay is also known as your premium. It is most commonly paid in monthly installments throughout the year. Of all the 3 steps, this is the only step that is guaranteed to take place each and every month you actively have the insurance service. Keep in mind that you’ll need to pay for the service whether you use it or not.

In terms of its use, insurance is kind of like one of those safety nets that are hung below tightrope walkers who perform high up off the ground. It’s there to catch them if they fall but just stays there unused if they don’t.

Car insurance works in a very similar way; you pay to have the protection available whether you end up in an accident and need to use it or not.

The core business concept behind car insurance is built around the logic of a lot of people paying money to the insurance company on a monthly basis while hoping that only a few accidents occur each month that require money to be paid out for repairs. That is how it’s possible for insurance companies to have you pay only a few hundred dollars a month to them, but then they pay out thousands of dollars to fix your car after an accident. This step will more than likely not be your favorite but making your monthly payments to the insurance company is an important part of the insurance ecosystem.

Later on, in the “Pricing” section, we’ll discuss additional information such as the factors affecting the amount of money you'll pay to have car insurance; but for now, just know that you will need to pay money to the insurance company to have the service.

Step 2

The second step speaks about “conditions” that must be met first before the third step can take place.

Generally speaking, there are two main parts to the conditions, damage & coverage.

The first focuses on damage, and when we say the word “damage” we actually mean either partial damage or complete loss.

One of the main reasons why car insurance was originally created has a lot to do with damage. As it’s damage that brings about the expenses for which the insurance service will protect you from. No damage = No expense = No need for insurance protection.

Car insurance is basically a forgotten service if everything is fine, and your driving is perfect. This is true because if nothing goes wrong and no damage occurs then there is no reason for the insurance company to pay out any money to fix anything.

So, damage must occur in order for an event to qualify.

And when we say “event”, we mean an incident that occurred for which the insurance company may need to pay money out. Take for example, if you backed your car out of the garage and accidentally hit your garbage can. Upon inspection, there isn’t any damage to your car. Yes, the event occurred, but there wasn’t any damage to report to the insurance company.

If, however, damage occurs in an event then we take a look at the second condition, coverage.

This part of the conditions states that you must have coverage for that damage for the event to completely qualify.

Let’s explain.

So earlier we mentioned that car insurance is all about providing “protection”. That’s true; but furthermore, having coverage is actually how you’re able to get that protection.

To have coverage is to have the protection of insurance; and so, you must have coverage in order to actually be protected.

Full coverage is not automatic; so simply having car insurance doesn’t automatically mean you’re protected in every way. No, you actually need to decide on the amount of coverage you want and exactly what you want to protect.

In theory, choosing your car insurance coverage could be seen as playing a game of risks. The way the game works is that you decide on a list of “items” or “areas” for the insurance company to protect in the event damage or loss occurs. These items/areas may include yourself, your car, or other cars, for example. The more items you protect the more coverage you have and the greater the cost will be. For most people, the tricky part will be finding a balance between the number of items they want to protect and the price they have to pay for all that protection.

The list of items being protected is what the insurance company will cover you for. And by “cover” we mean to step in and pay for expenses related to those items.

Only what is listed as part of your coverage will be of importance to the insurance company when damage occurs, and it is time for them to pay. So, getting this list right is super important.

If something were to receive damage that was not on the agreed-upon list, then the insurance company would not pay out any money to fix that item. No coverage = No payout.

So, for example, if you got into an accident that resulted in damage to you (1 item) and your car (another item); but you only bought coverage for your car and not yourself. Then the insurance company will only pay to have your car repaired and will not pay for any of your medical bills since you do not have coverage for it.

That’s the basic idea of what coverage is; simply put, it’s a list of items you choose to protect. We’ll go into much more detail about the topic of coverage in the next section, but this should give you a general idea of what it is.

So, if both conditions (damage and coverage) are met, then the third and final step takes place.

Step 3

That third step involves the insurance company paying out money to fix the situation.

To start the third step, you'll need to file a claim with the insurance company. Filing a claim is the formal way to report damage to the insurance company. It's also the official way to request payment for expenses since the conditions/terms of the insurance policy have been met. Each insurance company may have different guidelines to follow when filing a claim, and so we can’t speak much about a specific process you should follow when doing so. Just make sure you’re fully aware of the process to file a claim with the insurance company you end up purchasing car insurance from.

One thing to note, when it comes to the insurance companies paying out money, is that most of the time the money being paid out goes to other businesses to get things fixed. Like to the mechanic or body-works shop or a hospital. You won’t directly get the money being paid out, for the most part.

Also, as you will see in the final section on “Other Factors”, the companies who are able to more quickly/efficiently pay up and resolve claims will appeal more to customers. That makes this step in the process, which we like to call “claims resolution”, a key factor when deciding between companies.

So that wraps up the question of how it works.

Now, let's take a look at the final question.

Why do we need it?

We previously spoke about the fact that in most states, car insurance is a must by law. And so, the first and most obvious reason you need it would be if it’s required in your state. That alone lets you know that you need it.

If it is required in your state, then please get it; as you can run into a whole bunch of legal problems if you choose to drive without it.

The second reason would be if it is required by a lender or financial institution. If you get a car loan to finance a car, most lenders will require that you get car insurance. Since you aren’t buying your car outright with your own money and are instead borrowing from a lender to pay for it, you’re considered a higher risk due to the debt. So most reputable lenders and car dealers will require insurance for your car to protect their investment. Once again, since it is required, you simply must get it.

The third and final reason would be because it’s actually a very good thing to have and so you should want to have it.

Now we’re not saying this just because we’ve worked for insurance companies in the past and are somehow trying to promote their service. No, we honestly do feel that it’s a good thing to have.

We say this mainly because of the fact that, like most other people, we don’t have a bunch of money lying around to spend on expenses if we end up in a major car accident. And so having a service that can deal with that financial burden for us isn’t so bad.

The true value of car insurance could be seen in the more extreme damage situations, like getting a car totaled. You could quite easily be responsible for more than $20,000 worth of damages.

And so we would prefer to pay hundreds of dollars to an insurance company monthly, and then let them be responsible for paying a large sum of money if we end up in a major accident; over not paying for car insurance every month, but then having to find tens of thousands of dollars on our own to pay immediately after a major accident.

Keep in mind that you will be held financially responsible for damage to other people and/or property, resulting from an accident you caused while driving without car insurance.

And if you don’t have the money to pay to fix the damage you caused, then you can also face legal issues and possibly even jail time.

The authorities may also try to get the money by taking away and selling other property you own (assets), such as another car or motorcycle. So having car insurance is also a sound way to protect your car and other assets.

If you’re not financially stable and don’t have a lot of money saved up, it’s best to pay to have the protection of car insurance.

With that being said; let's follow the law, keep our freedom, and protect our assets by making sure we drive with car insurance.

We’ve answered the third and final question and now know why we need car insurance.

That does it for this section on the basics. You should now have a general understanding of the topic of car insurance.

From here on out, as we move further into the other parts of the guide, we’ll be discussing more detailed information about car insurance.

The next section focuses on the topic of Coverage.