Disclaimer: We share general insurance tips and insights — not licensed advice. Always check with a qualified insurance professional before making decisions. See full Disclaimer.

Insurance Policy Authority

Insurance advice for auto, home, and life.

Auto Insurance: Pricing

After deciding on the amount of coverage you need, the next logical thing to consider is the amount of money you’ll have to pay to get that amount of coverage.

Ultimately, every auto insurance company can give you your desired amount of coverage; but they more than likely will offer you that coverage amount at different prices. The comparison of coverage amount to price is what determines how much of a “deal” you’re being offered. This should be the main deciding factor when comparing offers from different companies. There are other factors, such as customer service and claims resolution, which may steer you towards buying car insurance from a particular company; but we believe you should consider those other factors after getting the best deal on the amount of coverage you want.

Let’s take a look at some of the factors that can affect how much you’ll pay to get the coverage you want.

Factors affecting Price

There are many different factors that are used by insurance companies to determine how much to charge you. And each insurance company may use a different combination of factors to determine your price or premium.

The factors that insurance companies may use to determine your price can include:

-

Deductible Amount – higher deductible amounts lead to lower premiums; while lower deductibles lead to higher premiums.

-

Driving History – a good driving history leads to lower premiums; while bad ones normally result in higher premiums.

-

Age – insurance companies may classify very young and/or very old drivers as “high risk”; high-risk drivers generally pay higher premiums.

-

Gender – insurance companies may classify females as “safer” drivers, while men are considered more “risky”; high-risk drivers generally pay higher premiums.

-

Marital Status – married couples are considered more responsible and less risky; lower risks normally result in lower premiums.

-

Amount of Household Residents Covered – more people on the policy typically result in higher premiums.

-

Credit Score – a high credit score normally results in a lower premium; while lower credit scores result in higher premiums.

-

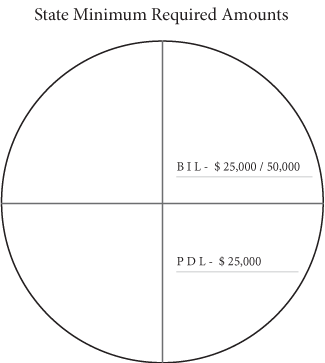

State – each state has its own “minimum required” amount of coverage; higher required amounts lead to higher premiums.

-

Area(urban/suburban/rural) – urban areas, such as cities and towns, may be considered more risky than rural areas due to higher traffic; higher risks lead to higher premiums.

-

Vehicle Type – sedans may be classified as safer to drive; while sports cars are seen as more risky; higher risks lead to higher premiums.

-

Vehicle Year – older cars carry higher risks than newer ones; higher risks lead to higher premiums.

-

Vehicle Use – it typically costs more to insure a vehicle used for business than one for personal use.

To some people, the ways in which insurance companies choose to perceive these factors may seem a bit unfair or unjust. And so we must clearly state that we are not saying that insurance companies use all or any of these factors listed above in any specific way. We are simply indicating how industry trends typically view these factors.

Another factor that could affect your price is if you add any of the “Other Coverages” to your policy. These include coverages such as Rental Reimbursement and Towing/Roadside Assistance. These optional coverage types are added or bundled to your main coverage but typically come at an additional cost. We decided to not include these in the list of factors above since they should be optional and so you get to determine if that factor affects your price and not the insurance company.

It’s very important for us to reiterate that most insurance companies won’t inform you of the factors used to determine your price/premium. And that each company may use a different combination of factors, as well as weigh the influence of each factor on your price, differently.

This is the main reason why you may receive different prices from different insurance companies for the same or similar amount of coverage.

It is also the reason why you need to seriously consider every single car insurance company available, from large national companies to small local car insurance companies.

In the retail business, when a small store is able to price a product cheaper than a larger supermarket, it may be a cause for concern. Is the product fake? Is it damaged? Is it expired or old stock? That’s because the logic governing how things normally work in the retail supply business is pretty simple; the bigger you are the more money you have to buy in bigger quantities. And so large supermarkets have the buying power to purchase in larger bulk quantities at cheaper rates; hence the reason why they can normally offer the product cheaper than smaller stores.

But the business of selling car insurance doesn’t work like that since it isn’t governed by that same logic. That’s primarily because the product being sold is a service and not something physical you can source in bulk quantities. That means there isn’t a clear buying-power advantage for larger car insurance companies and so that puts most companies in the industry on a more level playing field. Because of this, it is possible for smaller insurance companies to legitimately offer better deals than bigger ones; primarily based on the combination of factors they use to determine your price.

The car insurance industry is super competitive and the companies within are often seen as gamblers playing a game of risk. Some smaller companies may take a greater risk to insure you at a lower price in order to increase their customer base. There’s nothing wrong with this and it shouldn’t discourage you from choosing a smaller insurance company.

Keep in mind that you are protected since a car insurance policy is a legally binding contract between you and the insurance company. And so ultimately, the risk and obligation to have the money needed to repair your car is solely with the insurance company and not you, regardless of the size of the company. So don’t be afraid to shop around and entertain offers from any legitimate car insurance company, big or small.

Car Insurance Quotes

A car insurance quote is an estimated price put forward by an insurance company for providing you with a specified amount of car insurance coverage. It is only an estimate and not your premium (final price); although it most often ends up being the same or very similar.

The value of the quote normally changes based on the amount of coverage you choose; often with higher prices for higher coverage amounts.

When getting quotes from insurance companies, be prepared to provide a lot of information about yourself, other household residents, and your car. As this information is what is used to determine your quote.

You can request a quote from an insurance company online or in-office.

Offer Comparison Tool

Generally speaking, there are two main types of shoppers for car insurance, those with a specific price point in mind and those with specific coverage levels in mind.

For both, we have created our Offer Comparison Tool (OCT), which is designed to make comparing quotes as easy as possible. You will have all the information needed right in front of you to easily decide on which offer is best.

There is an Offer Comparison Tool available for each state. For illustration purposes, we’ll use the OCT for the state of Alabama to show you its various parts. Click on Alabama OCT and it will appear.

The first page on the OCT is the “Coverage Information” sheet, which contains all the relevant information about coverage in that state.

Starting at the top left corner, the first information provided is the State Minimum Required Amount of coverage.

Note that the state minimum stated here is the “bare” minimum, and so only lists coverages that you must get. In the original state minimum chart, we also included coverages that must be offered to you but that you could ultimately reject in writing. Since those are technically not a must, we left them out so you can see the absolute least amount of coverage you are allowed to get.

Next is the Industry Recommended Amount of Coverage.

Both the industry-recommended amounts and the state minimum were already provided in the previous section but were still included for your convenience.

Next is the Common Coverage Levels in the State.

This chart states the common coverage amounts other people in your state purchased. This should give you an idea of what the average person has. As seen in the example image above, most people purchase at least one type of coverage per area.

Next is Your Ideal amount of Coverage.

This is the information you wrote down from the previous section with the coverage amounts that would be enough for you. You can write in the information from that piece of paper or simply come up with amounts if you didn’t do so prior.

This section is particularly important to the buyer who has a particular coverage amount as their main priority. This will be the focal information when getting and comparing quotes.

For the buyer who has a price point in mind, and specifically, those who are basically looking to purchase the minimum amounts, you need not worry too much about filling in that information since the state minimum is already listed on the sheet.

Lastly on this sheet is Your Desired Target Price.

This information is most important to those looking to spend a certain amount of money on car insurance. Fill in your desired target price and the Coverage Information sheet is completed.

You should have this completed sheet available whenever you request a quote and are filling out the offer sheets.

The last two pages are the actual “Offer Comparison” sheets. Here is where you will actually be comparing the quotes you receive. Since it is recommended that you get at least three quotes, we made space available to compare three quotes on each sheet; giving you the power to compare a total of six quotes, to further ensure that you find the best deal possible.

Each of the three offer slots holds the same information.

Starting at the top is the space for the company name and the price of the quote.

Below that is the empty coverage chart to fill in the types and limits offered by the insurance company.

Next are the slots for optional coverage types you can add to your policy and the cost of each if it’s not already included in your price.

And then further down is the ratings section where you can compare “separator” factors. The ratings section is primarily used to compare other factors (such as the level of a company’s customer service) when we have multiple companies offering the same amount of coverage at a similar price. You’ll be able to rate them in order to determine who has the best. This topic will be discussed in more detail in the next section on Other Factors.

Getting Quotes and Comparing Offers

It’s now time to go out and get quotes so that you can compare them. You can start by printing out the Offer Comparison Tool for your particular state. Simply click on your state’s name in the list below and the OCT for that state will appear.

Offer Comparison Tool List

The National Association of Insurance Commissioners (NAIC) recommends you get at least three quotes when you shop for car insurance.

When requesting quotes from insurance companies, be sure to ask for the same core coverage types and limits from each company; as well as the same optional coverage types. This will allow you to make the best comparison.

For each quote/company, see how much the price changes if you choose different deductible amounts. Increase or decrease the deductible amount to see if there is a significant change in the price.

Try to get a combination of quotes from national companies (or what we like to call the “big boys”) and local ones; as well as a mix of online and in-office.

As previously mentioned, people looking to buy car insurance fall into one of two main categories; those looking to buy based on a certain price point, or what we like to call the “budget” shoppers; and those looking to buy based on a certain amount of coverage or the “coverage needs” shoppers.

Depending on the type of shopper you are, either a price point or coverage needs shopper, you may go about getting your quotes in different ways.

For the budget shopper looking to find the cheapest price, you can simply enter the minimum coverage amount for your state-required coverage types on each quote and see who ends up offering the lowest price.

For the price point shopper looking for a particular price (but not necessarily the cheapest price), you can start off each quote with the bare minimum and then start to increase your coverage until you hit your target price. This will allow you to clearly see who is offering the most insurance for that particular amount of money.

Those who have a specific coverage amount in mind can simply enter their desired amount of coverage in each quote and then see who has the lowest price.

Doing these types of comparisons lets you clearly see who is offering the best deal when comparing insurance amounts to price. And remember that getting the best deal should be the main deciding factor when choosing a company/policy.

Don’t forget to ask about discounts, as you may be qualified for upfront discounts. They’re often available if you choose to bundle your auto and home insurance, insure multiple cars, or if you’re a part of certain organizations or companies. And if you do get any discount, be sure to deduct it before you finalize your quote total.

Look for Discounts

Insurance companies offer a variety of discounts for car insurance to help lower premiums. Here are some common types:

-

Multi-Policy Discount: Savings for bundling car insurance with other types of insurance, like home or renters’ insurance.

-

Safe Driver Discount: For drivers with a clean driving record, often requiring a certain number of years without accidents or violations.

-

Good Student Discount: Available for students who maintain a high GPA, usually in high school or college.

-

Low Mileage Discount: For drivers who don’t drive many miles each year; since lower mileage can reduce the risk of accidents.

-

Safety Features Discount: For cars equipped with safety features like anti-lock brakes, airbags, or advanced driver-assistance systems.

-

Pay-in-Full Discount: A discount for paying the entire premium upfront instead of in installments.

-

Military or Professional Discounts: For active military personnel or certain professions, like teachers or nurses.

-

Loyalty Discount: For customers who stay with the same insurance company for a certain number of years.

-

Retirement Discount: Sometimes offered to retirees who may drive less frequently.

-

Telematics Discount: Based on driving behavior monitored through a mobile app or device, rewarding safe driving habits.

Always check with your insurance provider to see which discounts may apply to you!

Keep in mind that you will only need to focus on filling in the top two portions of the offer sheet (core and other coverage) and leave the rating section at the bottom empty for now. We will work on filling in that portion (if necessary) in the next section coming up.

At this point, we suggest that you take a break to collect quotes and have all the offers from different companies available for comparison.

That does it for this section on Pricing.

Now we move on to the final section that discusses Other Factors.